Fraude y Estafas

Anyone can fall victim to fraud and identity theft, but seniors are often inundated with investment offers, promises of instant wealth and requests for charitable contributions. Seniors are less likely to report fraud for many reasons: they don’t know how to report the scam, are ashamed of being scammed, or don’t know that they have been scammed. Also, seniors may not report the crime because they’re concerned that relatives may think they no longer have the capacity to manage their own finances. Unfortunately, lack of reporting contributes to keeping seniors at risk for fraud and identity theft. The alerts below will provide you with additional information on how to protect yourself from scams:

A continuación proporcionamos la información de contacto de cada una de las tres agencias de informes de crédito para activar una alerta de fraude en su informe de crédito.

Equifax

www.equifax.com/personal/credit-report-services/

P.O. Box 105069, Atlanta, GA 30348-5069

1-800-685-1111

P.O. Box 9554, Allen, TX 75013

1-888-397-3742

TransUnion

www.transunion.com/credit-help

P.O. Box 2000, Chester, PA 19016

1-800-680-7289

Below is the contact information to place a security freeze on your credit report:

Equifax

www.equifax.com/personal/credit-report-services/

P.O. Box 105788, Atlanta, GA 30348-5788

1-800-685-1111

Experian

P.O. Box 9554, Allen, TX 75013

1-888-397-3742

TransUnion

www.transunion.com/credit-help

P.O. Box 160, Woodlyn, PA 19094

1-888-909-8872

Estafas a Consumidores

Scammers are always finding new ways to take advantage of consumers by stealing their financial information but seniors are especially at risk for financial exploitation. It is estimated that seniors lose $2.9 billion each year to financial frauds and

scams. Studies suggest that financial fraud against seniors goes widely unreported, often out of embarrassment or fear that they will lose independence if their loved ones find out they’ve been deceived. No one wants to feel incapable of handling

their personal finances. Scammers dupe seniors into believing scams such as: their grandchild has been arrested and money must be wired immediately so that they can be released from jail or following a disaster or devastating event, scammers will

prey on the trusting nature of seniors to seek a false contribution.

La mejor manera de protegerse de las estafas y el fraude es estar informado. Conozca los métodos que usan los estafadores para aprovecharse de los consumidores y así poder detectar una estafa antes de convertirse en víctima. A continuación detallamos algunas de las principales estafas a consumidores que afectan a las personas mayores para ayudarle a mantenerse en alerta.

Los estafadores saben que muchas personas mayores tienen ingresos fijos y que la posibilidad de recibir fondos adicionales para complementar sus ingresos los convierte en un blanco perfecto para la estafa del préstamo de cargo por adelantado. La Estafa del Préstamo con Cargo por Adelantado ocurre cuando entrega dinero a cambio de un préstamo, contrato, donación u oportunidad de inversión, pero recibe muy poco o nada a cambio.

Pitch: Scammers guarantee that you will be approved for a loan, contract or other opportunity regardless of your credit history, but you must pay a fee upfront.

Result: The scammer will require you to sign a contract in which you agree to pay the fee. You will then find out that you are ineligible for the offer but have already paid the non-refundable fee.

How to avoid this scam: If it sounds too be good to be true, it probably is. This scam is a key example of this phrase. Before signing any agreement, thoroughly review it and make sure you completely understand it. Check with your local bank or credit union to determine your financial options.

Las estafas con donaciones de caridad son muy populares después de que ocurre una catástrofe o evento devastador.

Pitch: The scammer claims to be affiliated with charitable organizations such as: the American Red Cross, Police Benevolent Association and the Firefighters Association following a disaster. The scammer informs you that donations are being collected to assist individuals who were affected by the recent disaster in the area. The scammer claims that a goal has been set and they really need your help to reach that goal; the contribution must be made today. Contributions can be made via check, credit card or prepaid debit card.

Result: Never give out your personal or financial information over the phone unless you initiated the call. Do not be pressured into contributing. A reputable charity will be happy to take your contribution anytime.

How to avoid this scam: Only donate to local and familiar charities and research those you are not familiar with. Verify if a charity is registered by visiting the Florida Department of Agriculture and Consumer Services’ Check-A-Charity page.

Whether you are selling a couch on Craigslist or responding to a job ad, this scam usually works this way: the person you are doing business with “accidentally” sends you a check or money order for more than the amount they owe you. They ask you to deposit it into your bank account and then send them the difference via a wire service such as Western Union or MoneyGram. A deposited check or a money order takes a couple of days to clear, whereas wired money is gone instantly. When the original check bounces or the money order is returned as fraudulent, you are out whatever money you wired…and you’re still stuck with the old couch.

Discurso: El estafador le dice que emitió el cheque o adquirió el giro por mucho dinero y le pide que le gire o transfiera la diferencia.

Result: The scammer’s check bounces or the money order is fake and the money you sent them is gone forever.

How to avoid this scam: If possible, only take cash for payment. If you must take cash or a money order, verify with a financial institution that it is legitimate and that sufficient funds are available before depositing it into your bank account and closing the transaction. Don’t trust anyone you don’t know, especially if they are asking for money.

Las nuevas tarjetas de crédito y débito con chip están diseñadas para reducir el fraude, pero los estafadores las ven como una oportunidad para cometer fraude.

Las instituciones financieras y compañías de tarjetas de crédito están enviando por correo las nuevas tarjetas de débito y crédito con un microchip integrado, que ofrecen otro nivel de seguridad, pero no todos han recibido la tarjeta nueva.

This delay allows scammers to try to capitalize on consumers who haven’t received a new chip credit card.

Pitch: You receive an email or phone call from a financial institution or credit card company stating that your personal account information needs to be updated so that your new credit card with a microchip can be issued. The scammer states that this can only be done by confirming some personal information or clicking on a link.

Result: The scammer has access to your personal and financial information and can open fraudulent accounts in your name or steal your identity.

How to avoid this scam: You can protect yourself from the chip card scam by not clicking on a link in an email, or providing personal or financial information by phone to someone claiming to be from your financial institution or credit card company. If you’re concerned that the email or call may not be legitimate, contact your financial institution or credit card company at the phone number listed on the back of your credit card or statement to verify the call. Remember, your credit card company or financial institution does not need you to verify information prior to sending a new card.

La Comisión Federal de Comercio advierte a los consumidores que estén atentos a los estafadores que se hacen pasar por cobradores de deudas. A veces puede ser difícil darse cuenta de la diferencia entre un cobrador legítimo y uno falso. En ocasiones los cobradores falsos pueden tener alguna información personal sobre usted, como su número de cuenta.

Pitch: Phony debt collectors may pose as attorneys or law enforcement officers demanding immediate payment on delinquent loans or on loans you have received but for amounts you do not owe. The scammer may threaten you with garnishments, lawsuits or jail if you do not pay. These scammers will often us Caller ID spoofing. This technology makes it easy for scammers to disguise a phone number and the location they’re calling from.

Result: Consumers are threatened with lawsuits or arrests if payments are not made immediately and may end up giving money or personal information out of fear.

How to avoid this scam: Ask the scammer for their name, company, street address and telephone number. Tell the scammer that you refuse to discuss any debt until you get a written "validation notice." The notice must include the amount of the debt, the name of the creditor you owe and your rights under the federal Fair Debt Collection Practices Act. If a scammer refuses to give you all or any of this information, do not be afraid to hang up and do not pay! Paying a fake debt collector will not always make them terminate contact. They may make up another debt to try to obtain more of your money.

Esta estafa afecta a los ancianos que tienen nietos.

Pitch: You receive a call from someone claiming to be your grandchild and states they have been arrested in another country and need money wired immediately. The scammer asks that you don’t tell their mom or dad because this will upset them.

Resultado: Usted transfiere el dinero pero descubre que su nieto estaba a salvo.

How to avoid this scam: Tell your family not to post travel plans online. Scammers can use online information to contact family members. Don’t trust caller ID. Scammers can disguise the number that appears on the caller ID with a practice called “spoofing.” Technology is available to scammers that make it look like they’re calling from a different place or phone number. If you get a call from your “grandchild” asking for bail money, ask for the name of the bond company and call them directly to verify it is true.

Cuando dude, pregunte algo que solamente un familiar suyo podría saber o cree una palabra clave que sepan solamente sus familiares para usar en el caso de alguna emergencia.

Look out for home improvement contractors who leave your home worse than they found it. They usually knock on your door with a story or a deal – the roofer who can spot some missing shingles on your roof, the paver with some leftover asphalt who can give you a great deal on driveway resealing. Itinerant contractors move around, keeping a step ahead of the law…and angry consumers.

Pitch: There’s a knock on your front door and you answer it. A contractor says he has just finished a job in your neighborhood and has load of asphalt material left over. Rather than take a loss on the supplies, he offers to repave your driveway at a reduce cost. Or, a handyman shows up after a storm with a list of suggested repairs for your property.

El estafador también puede ofrecerse a realizar tareas a cambio de una asignación de beneficios en su póliza de seguros, lo cual significa que, una vez que se complete la reclamación a través de su compañía de seguros, el cheque se entregará directamente al contratista y no a usted. El cheque de la reclamación puede superar el costo real de las reparaciones necesarias para los trabajos en su casa y los trabajos pueden completarse con materiales inferiores. Nunca acepte este tipo de acuerdos a menos que esté absolutamente seguro de que el contratista es legítimo, que tiene una licencia y que cuenta con el seguro adecuado.

Result: The work may be poor quality and you may have to redo the entire job at your own expense. The scammer may file a false or inflated claim with your insurance company, which could cause an increase in insurance premiums. The scammer may take your money and not complete the job.

How to avoid this scam: Verify Before You Buy! Verify with the DFS’ División de Compensación Legal por Accidentes de Trabajo if they have workers’ compensation coverage. If they don’t, you could be liable for any injuries that happen on your property. Also, check out the company with the Oficina de Buenas Prácticas Comerciales. Pida copias de su licencia y número de contratista para guardarlas en sus registros.

Las estafas relacionadas con impuestos fueron las más populares en 2016. La estafa del IRS es un tipo de estafa impositiva en la que una persona dice ser del IRS y exige el pago de impuestos atrasados.

Pitch: Someone calls claiming to be from the IRS. Your caller ID identifies that the call is from the IRS. The scammer may use a false name and IRS identification badge number. To add creditability, they may ask you to verify some personal information such as: your full name, date of birth, home address, and the last four digits of your Social Security Number, all of which can be found on the internet. You are told you have an outstanding debt to the IRS and if a payment is not received immediately you could be arrested or a lien placed on your property. Typically, the scammer will instruct you to purchase a Green Dot prepaid debit card or wire the payment via Western Union or MoneyGram to settle the debt. The IRS does not use the phone, email, text message or any social media to discuss your personal tax issues involving bills or refunds.

Result: The scammers are only trying to get a quick payout. Unfortunately, it is almost impossible to recover any money you have wired or sent via a prepaid debit card.

How to avoid this scam: Do not automatically trust that a call is coming from the IRS based on the caller ID. Technology makes it easy for scammers to disguise the phone number with a practice called “spoofing.” Remember that the IRS will never call you without first sending you a hard-copy bill and it will never demand payment without offering you the chance to appeal and correct any error on your tax documents. Many seniors are not required to file tax returns because they earned little or no income. Consult with a tax professional to determine if you are required to file.

For more information, visit the IRS’ Tax Scams and Consumer Alerts .

El servicio de jurado es una responsabilidad cívica importante y debe tomarse seriamente. Lamentablemente, los estafadores usan esto a su favor para cometer esta estafa.

Pitch: You receive a phone call stating that a warrant has been issued for your arrest because you missed jury duty. The scammer claims to be a law enforcement officer or court appointed official and says you owe a fine that must be paid immediately to avoid arrest. The call appears authentic thanks to caller ID spoofing. This technology makes it easy for scammers to disguise a phone number. The scammer may ask that you provide your birth date and Social Security Number to verify your identity.

Para evitar el arresto, el estafador dice que puede pagar la multa por transferencia bancaria a través de Western Union o MoneyGram, una tarjeta de débito prepaga Green Dot o al proporcionar la información de su cuenta bancaria.

Result: Do not respond to requests for personal or financial information, or for immediate payment. Giving this type of information can open the door to identify theft and you risk paying an unnecessary fine.

How to avoid this scam: When in doubt, hang up. If you feel you have missed a jury duty summons, call your area County Clerk’s Office to verify. The court will never request your personal information or immediate payment over the phone.

Los estafadores intentan convencer a los adultos mayores que se hicieron ricos a través de la estafa de la lotería.

Pitch: The scammer will approach you in public claiming to have won the lottery but doesn’t have a bank account to deposit the funds. They will gladly share their new found wealth with you if you will provide payment upfront in ’good faith.’ Be on guard. Never deposit a check into your bank account or give money to someone claiming to have won the lottery unless you ensure the funds are available.

Además, los estafadores pueden contactarse con usted por teléfono o email diciendo que ganó un premio o la lotería pero tiene que pagar un cargo antes de cobrar lo ganado. Le dirá que compre una tarjeta Green Dot o que transfiera el dinero a través de Western Union o MoneyGram para pagar los cargos. Una vez que proporciona el número de identificación del reverso de la tarjeta Green Dot o el número de verificación de Western Union o MoneyGram el dinero desaparece y no podrá recuperarlo.

Result: The check provided by the scammer is fraudulent. Typically, it takes weeks for a financial institution to discover a fraudulent check and you are responsible for paying back the full amount of the check and associated fees. If you wire money to the scammer to claim your prize, you may never hear from them again, or they keep calling you and saying that the fees have increased and you need to wire more money.

How to avoid this scam: If you won a legitimate lottery, all fees and taxes will be deducted prior to receiving the prize. Once you wire money to a scammer in a lottery and sweepstakes scam they won’t go away. The best thing to do is not to respond to phone calls or emails claiming you have won a lottery. If you hear you have won a “free gift,” vacation or prize, say “No thank you,” and hang up the phone. Be alert for individuals who approach you in public wanting to share their new fortune with you. If it sounds too good to be true…it is.

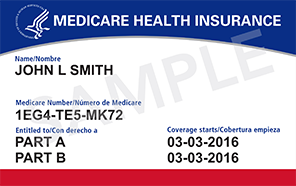

If you haven’t received your new Medicare card, call 1-800-MEDICARE (1-800-633-4227) and guard your current Medicare card that, if obtained by a scammer, can still be used to fraudulently obtain medical services or medications.

- If you haven’t received your new Medicare card, call 1-800-MEDICARE (1-800-633-4227) and guard your current Medicare card that, if obtained by a scammer, can still be used to fraudulently obtain medical services or medications.

- Start using your new Medicare card right away. Shred your old card to protect your personal information.

- Proteja su nuevo número de Medicare.

- Do not provide financial or personal information to someone asking for payment to obtain a new Medicare card or to verify personal information to receive the card. CMS has already mailed out new cards at no charge and will never call you to ask for

your Medicare number or other personal information.

- Si cree que su número de Medicare viejo o nuevo puede haber sido utilizado, llame al 1-800-MEDICARE (1-800-633-4227).

Many consumers prefer the convenience of online shopping over conventional shopping. There is no need to look for a parking space, no waiting for assistance from a salesperson or having to wait in long lines at the checkout. You are able to shop 24/7, even wearing your pajamas. The latest technology allows scammers to set up bogus retail websites that look like legitimate online retail stores. Scammers may use a logo, design and layout similar to the true website. They may even create a “.com” domain similar to the store’s name to perpetrate the scam.

Pitch: Scammers pretend to sell items or services at a discounted price to attract consumers. These unsuspecting consumers looking for bargains oftentimes fall victim to this scam.

Resultado: Puede pagar por artículos de mala calidad o nunca recibirlos. Hace el pago con un giro a través de Western Union o MoneyGram, una tarjeta de débito prepagada Green Dot o suministrando la información de su cuenta bancaria. Puede ser víctima de robo de identidad después de proporcionar información personal. Además, si hace clic en determinados enlaces puede infectar de malware su computadora o teléfono.

How to avoid this scam: It’s important to do your research on a company or seller before buying from them. Make sure the business has a physical address and telephone number you can contact if there's a problem. Ensure the website is secure before providing your personal financial information; if not, this may lead to identity theft. Look for the lock symbol or “https” at the beginning of the website address.

Los servicios de pago de persona a persona (P2P) como Apple Pay, Zelle, Venmo, Facebook Payments y Cash App ofrecen una forma rápida y práctica de enviar dinero a sus familiares y amigos. Lamentablemente, también son un método de pago popular para los estafadores.

Online Advertising Pitch: This scam can appear in a variety of ways, including as a part of another type of scam. Scammers will request payment for goods or services advertised to be made through a P2P platform like Apple Pay or Venmo. Most often, this scam is seen online as part of an online retailer or classified advertisement sale scam. Scammers may also request funds through a P2P payment service as part of a romance scam, fake check scam, puppy scam or any other ploy to trick you out of your hard-earned dollars.

Target: All consumers, especially online consumers.

Result: The consumer will pay for the goods or services with a P2P payment service but never receive the product or service advertised. Many consumers mistakenly believe that P2P payment services have protections similar to a debit or credit card since many P2P payment services are affiliated with banks. This is not true. Once you send money via a P2P payment service, it is nearly impossible to get the money back.

Cómo evitar la estafa:

- Do not use P2P payment services (Apple Pay, Zelle, Venmo, CashApp) to purchase products. If an online retailer only offers payment with a P2P payment service, it is probably a scam.

- Only send money through P2P payment services to people you know. P2P payments are intended to be used between friends and family, or with people you know well and trust, like your hairstylist or a babysitter.

- Double- and triple- check the address, username, or phone number of the person you are transferring money to. If you make a mistake and send the money to the wrong person, it can be very difficult or even impossible to get the money back. If you are worried you may have the wrong person or want to ensure the process works, try sending a very small amount first to confirm that your intended recipient received it.

- Use all security features offered. Almost every popular P2P payment service offers the ability to create a personal identification number (PIN). Once the PIN is created, a user will be required to enter it when they open the app, or before they are able to transfer money. This extra layer of security can help protect your money if your mobile device falls into the wrong hands.

For many consumers it’s a daily routine to check emails. But, what happens when you receive an email stating you have won a contest or your financial institution advises that your account may have been compromised. The email asks for your personal information to confirm receipt of the prize or to verify your account information. The email may look authentic but can redirect you to a site that downloads malware on your computer to search for sensitive data.

Pitch: You get an email or phone call informing you that you have won a contest or your financial account may have been compromised. You are directed to click on a link to and follow the directions on the page to claim your prize or verify your personal information.

Result: The scammer has access to your personal and financial information and can steal your identity.

How to avoid this scam: You can protect yourself from the phishing scam by not clicking on a link in an email that claims you have won a contest or from your financial institution asking for your personal information. If you believe the email may be legitimate, contact your financial institution via the telephone number listed on your account statement or contact the organization offering the prize at a number found online or in a directory.

En el mundo actual de las citas en línea es mucho más fácil encontrar a una persona compatible, pero también es mucho más fácil que un estafador busque a sus próximas víctimas.

Pitch: The scammer pretends to develop romantic intentions through online dating websites and social media to gain your affection and trust. Over time, the scammer will begin asking for money, perhaps for an airline ticket to travel to the United States to visit you, medical bills or expensive internet/phone bills to continue the relationship. The scammer will ask that you wire money via Western Union or MoneyGram or a prepaid debit card such as a Green Dot card.

Result: You send the individual money for the specific expenses and receive nothing in return, or the scammer continues to request money.

How to avoid this scam: Be vigilant while on the internet. Be cautious and leery of those you meet while on the internet and those you have never met in person. It is also advised that you do not send money to an individual that you do not know.

Don’t trust the caller ID it may be misleading. Scammers use spoofing technology to control the information that appears on your caller ID. Scammers can make you believe the Social Security Administration is calling you. If you receive a call from Social Security, you may not want to answer it. Instead, call Social Security directly at 1-800-772-1213 to determine if the call was legitimate.

Stay Informed. Rest assured, Social Security will never suspend your SSN. Also, the Social Security Administration will never call demanding payments in the form of wire transfer, gift cards or cryptocurrency.

Be cautious when giving out your personal information. Being asked to confirm your SSN or bank account information over the phone or by email is likely a scam.

- Be wary with callers claiming to know some of your personal information. Unfortunately, scammers may have obtained some of your personal information through recent data breaches. Scammers may use this to their advantage in attempting to convince you they are legitimate entities. Just because a caller knows your SSN, doesn’t mean you should share more personal information with them.

Cada año, los consumidores esperan con ansias presentar su declaración impositiva con la esperanza de recibir un reembolso para pagar una deuda o agregar a sus ahorros o fondo de emergencia. Los ladrones de identidad tienen el mismo objetivo, pero a expensas de los consumidores.

Pitch: The tax identity theft scam is a version of the tax scam in which a scammer uses the victim’s personal information to file a fraudulent tax return and illegally collects the tax refund. Filing a false tax return only requires the victim’s name, Social Security Number, date of birth and a falsified W-2 form.

Result: The victim attempts to file their own, legitimate tax return and receives a letter from the IRS indicating that someone has already filed in their name.

Cómo evitar esta estafa:

Inscríbase en el Programa Piloto de PIN de Protección de Identidad del IRS. Si el año pasado presentó su declaración de impuestos federales con un domicilio en la Florida, Georgia, el Distrito de Columbia, Michigan, California, Maryland, Nevada, Delaware, Illinois o Rhode Island, es elegible para un PIN de PI del IRS, un número de 6 dígitos que se asigna anualmente y ofrece protección adicional para los contribuyentes que viven en zonas donde prevalece el robo de identidad relacionado con impuestos. Este PIN de PI ayuda a prevenir el uso indebido de números de Seguro Social en declaraciones fraudulentas de impuestos sobre la renta. Si opta por recibir un PIN de PI, debe usarlo en todas las declaraciones futuras. Obtenga su PIN de PI del IRS en https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin.

Presente su declaración impositiva con anticipación, incluso si no tiene ingresos, cree que sus ingresos están por debajo del mínimo necesario para presentar la declaración, es un trabajador independiente o recibe beneficios del gobierno, como Seguro Social. Esto reduce la cantidad de tiempo que un ladrón de identidad tiene para presentar una declaración en su nombre.

Esté informado. La Ley de Protección para los Estadounidenses de los Aumentos de Impuestos (PATH) exige al IRS retener los cheques de reembolso hasta el 15 de febrero para consumidores que solicitaron el Crédito Impositivo de Ingresos Devengados (EITC) o el Crédito Tributario Adicional por Hijo (ACTC). Tenga cuidado con las compañías que se dedican a la preparación de impuestos que le dicen poder conseguir su reembolso antes del 15 de febrero. La compañía podría estar dándole un préstamo de altos intereses que se comerán su reembolso.

Verifique el estado de su reembolso en el sitio web del IRS.

Use la preparación de impuestos gratuita de organizaciones legítimas. Procure usar un programa de Asistencia Voluntaria de Impuestos sobre la Renta (VITA) en su comunidad. Puede verificar la compañía en el sitio web del IRS.

Use el IRS’s Free File program.

Si es una víctima:

Presente un formulario 14039 en el IRS.

Presente una denuncia de robo de identidad en su departamento de policía local.

Piense en pedir que se congele su informe crediticio, que evita que se abran cuentas de crédito en su nombre.

Para mayor información visite www.IRS.gov y www.Consumer.FTC.gov.

Many taxpayers will utilize the services of a professional tax preparer to file their returns. Unfortunately, not all tax preparers will have their clients’ best interest in mind. In 2015, the Department of Justice, Tax Division permanently closed the doors on more than 35 tax return preparers due to fraud. Fortunately, the majority of tax return preparers are honest. But, this does not mean you should trust your tax and personal information with everyone. The tips below will help you recognize a fraudulent tax preparer to avoid becoming a victim of fraud.

Verifique que su preparador de impuestos tenga un Número de Identificación de Preparador de Impuestos (PTIN) vigente. El IRS exige que todos los preparadores pagos tengan un PTIN. Revise el IRS’s tax preparer directory para verificar que su preparador de impuestos tenga PTIN y otras acreditaciones.

Nunca firme una declaración de impuestos en blanco. Un estafador puede completar una declaración en blanco firmada con créditos que no ganó.

Recuerde revisar cada sección de su declaración y hacer todas las preguntas necesarias antes de firmarla y que su preparador le entregue una copia completa y firmada de su declaración de impuestos.

Pregunte al preparador de impuestos si tiene servicios de presentación electrónica ante el IRS. La presentación electrónica al IRS es una forma segura y protegida de presentar su declaración de impuestos. Los contribuyentes reciben el acuse de recibo dentro de las 48 horas donde consta si el IRS aceptó o rechazó su declaración. Si la declaración es rechazada, el IRS explica cuáles son los errores que causaron el rechazo. Esto permite a los contribuyentes subsanar los errores y volver a enviar sus declaraciones.

Tenga cuidado con los preparadores que solo solicitan su recibo de pago para presentar una declaración. Un preparador legítimo también le solicitará su W-2 para presentar una declaración.

Evite los negocios poco confiables. Es importante garantizar que el preparador esté disponible para responder cualquier duda adicional que pueda surgir o para corregir errores que pueda contener su declaración.

Hable con el preparador y acuerde los honorarios antes de comenzar. Evite a los preparadores cuyos honorarios se basan en un porcentaje de su reintegro. Esta táctica permite a los estafadores aumentar su comisión reclamando créditos que no le corresponden. Para cuando el IRS identifique el error, su preparador habrá recibido su pago y usted podría tener una deuda fiscal.

Si tiene una multa fiscal, no la pague directamente a su preparador. Los pagos se deben hacer al Tesoro de los EE. UU. El preparador de impuestos debe entregarle un cupón que debe enviar por correo junto con su cheque o giro postal a nombre del IRS. También hay opciones de pago electrónico disponibles, como un débito directo de su cuenta de cheques o de ahorros, o pagos con una tarjeta de débito o crédito.

Pregunte a sus familiares y amigos de confianza quién prepara sus declaraciones y si recomendarían a su preparador.

For individuals who make less than $64,000 per year, the IRS’s Free File online program does not charge a fee to file a return.

Take advantage of free tax preparation from legitimate organizations. Be sure to use a Volunteer Income Tax Assistance (VITA) program in your community. You can verify the company on the IRS’s website.

For more information, visit the IRS’s Tax Scams and Consumer Alerts .

Muchos adultos mayores saben cómo usar una computadora y disfrutan de tener acceso a Internet para mantenerse en contacto con amigos y familiares. Lamentablemente, muchos estafadores se aprovechan de los adultos mayores desprevenidos que no están familiarizados con las computadoras e intentan engañarlos para que revelen información financiera personal por teléfono o email.

Pitch: You receive a phone call or an email from individuals posing as computer support technicians, typically Microsoft or Dell, asking to remotely access your computer or download software to fix a problem. They will try to sell you software to fix your computer or install malicious software to steal your personal information. Once the scammer has access to your computer, they are able to change the settings on your computer that could leave it vulnerable to viruses.

Result: The scammer may have installed spyware, which can cause your computer to slow down or sometimes crash. You have exposed your personal information and paid for computer software that, most likely, was not needed.

How to avoid this scam: You should never give control of your computer to a third party who calls or emails you. Do not rely on caller ID to verify a call. If you would like tech support, go to the computer company’s website and look for the support webpage or phone number. Never give out personal or financial information by email or over the phone unless you initiated the contact and you are certain the person you are speaking with is affiliated with the company.

El Departamento de Policía de Lake City advierte a los residentes, especialmente a los adultos mayores que asisten a la iglesia, acerca de una estafa local confirmada. Según la policía, los estafadores se acercan a sus posibles víctimas y se presentan como profetas o sanadores en viaje, y les piden que abran una cuenta bancaria para ayudarlos con sus viajes.

The scammers deposit counterfeit checks by mobile phone and ask the victim to withdraw money once the deposits are made. The victim is accountable once it’s determined that the checks are fraudulent.

El Departamento de Policía de Lake City solicita al público que esté atento a esta estafa y no abra cuentas bancarias para terceros. Las organizaciones religiosas legítimas tienen medios para recolectar donaciones.

Los residentes deben llamar al Departamento de Policía de Lake City si sospechan de alguna estafa.

Este es otro tipo de estafa relacionada con una reparación. El deducible para la reparación de un parabrisas no se aplica en la Florida ni en la mayoría de los estados. Los estafadores usan esta información para engañar a consumidores desprevenidos para cometer un fraude de seguros.

Pitch: The scammer approaches you in the parking lot of a grocery store or gas station, for instance, claiming that you have small chips or nicks in your windshield. They offer to replace the windshield to prevent from becoming cracked causing further damage. The scammer will misrepresent to your insurance company that the windshield is seriously damaged and needs repairing.

Result: The scammer is most likely not a licensed repairman and is not authorized to complete the repairs on your windshield. Many of these individuals may not be trained or are poorly trained, work out of vehicles with no physical business address and disappear quickly after completing substandard repairs. They may also charge your insurance company for inflated or baseless expenses and subpar materials.

How to avoid this scam: Contact your insurance company before allowing the repairs to be made. The company will help you confirm if the windshield needs to be repaired and find a reputable glass vendor.

Assignment of Benefits: Sometimes repair shops or their representatives may approach the claimants to assign their insurance claim benefits to them for glass repair. Such agreements are generally known as ‘Assignment of Benefits’, whereby a policyholder assigns their claim benefits to someone else. For policies issued or renewed on or after 07/01/2023 by authorized insurers, such assignments for glass repair and/or calibration or recalibration of Advanced Driver Assistance Systems (ADAS) are prohibited. These assignments are considered void and unenforceable. This prohibition applies to motor vehicle glass claims, including windshield claims.